OpenSys Technologies Eyes 30% Profit Contribution From New Solar Solutions

OPENSYS Technologies Sdn Bhd, a subsidiary of OpenSys (M) Bhd, is allocating RM650,000 of its total capital expenditure this year for system development amid the growth potential of the solar sector in Malaysia.

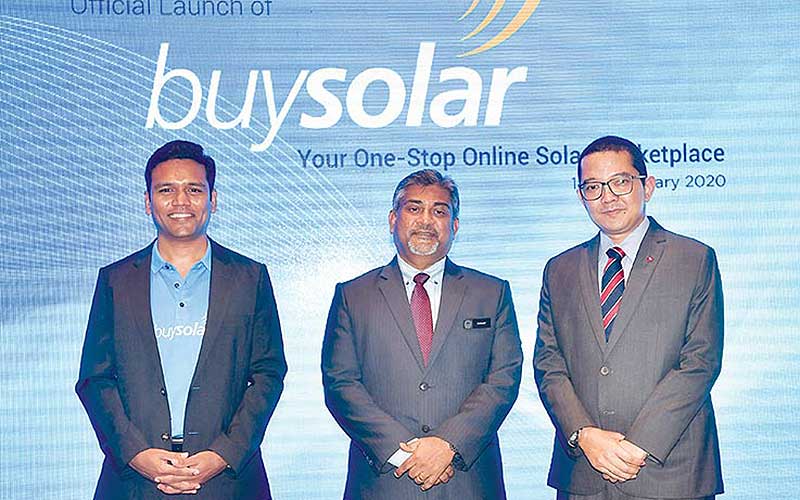

Following the launch of buySolar — Malaysia’s first one-stop online marketplace for solar services and products — the company has several more solutions in the pipeline including Internet of Things (IoT) monitoring, which uses smart cash-in-transit to transform the domestic secure logistics industry.

“We expect the services revenue generated from buySolar and the IoT solution to contribute 30% to the bottom line for the next three to five years,” OpenSys Technologies COO Luke Sebastian told The Malaysian Reserve.

Now is a good time for individual customers and businesses to begin using solar products, given that the “one-on-one” offset under the Net Energy Metering concept is applicable until the end of the year, he added.

“According to Sustainable Energy Development Authority Malaysia CEO Ir Dr Sanjayan Velautham, the ‘one-on-one’ offset would still be available after 2020, but the type of incentive could change, so this is the best time to go and lock in that savings,” Sebastian said.

The open-source software- focused company is targeting 500 users per month to apply for the installation of solar photovoltaic (PV) panels via buySolar.

About 80% of these are expected to be domestic residential consumers, while the remaining 20% will be commercial and industrial customers.

The buySolar platform provides end-to-end solar installation services, which include the online status of application, cost estimation, solar installer selection, standardised quotation, financing, online monitoring maintenance and after-sales services.

Tenaga Nasional Bhd’s (TNB) subsidiary GSPARX Sdn Bhd will oversee solar quotations, while TNBX Sdn Bhd, also a wholly owned unit of TNB, will offer the Supply Agreement for Renewable Energy scheme.

TNBX will also provide contracting, metering, billing, collection, disconnection and customer management for asset owners and investors.

CIMB Bank Bhd and CIMB Islamic Bank Bhd will provide financing options to customers specifically for solar energy, in the form of green loans.

By installing solar panels, customers can reap the benefits of energy savings that could potentially range from 54% to 87%, depending on the amount of energy used and the size of the rooftop.

The solar panels could last up to 25 years, Sebastian added. “Sourcing for reliable solar panel installers and getting the right financing option can be challenging for Malaysian customers because of the complexity of the process and lack of awareness of the trusted financing partner.

“The objective of buySolar serves to consolidate all the processes, which includes buying, installing, and servicing the panels, making it a one-stop solution which is easy for Malaysians to utilise renewable energy (RE) in their everyday lives and businesses,” he said.

Meanwhile, CIMB — which has allocated RM100 million for RE financing — is providing financing from RM20,000 to RM1 million, which covers the full cost of acquiring and installing RE technology, CIMB Islamic Bank CEO Ahmad Shahriman Mohd Shariff said.

Source: The Malaysian Reserve Online