Get In Touch With Us For A Quotation

SOLAR FOR YOUR BUSINESS

Power Your Commercial Property With Solar Energy With Solar ATAP or SELCO Schemes

EMBRACE SOLAR ENERGY WITH COMMERCIAL SOLAR SOLUTIONS

Harnessing Malaysia's sunshine, commercial solar solutions offer a sustainable and cost-cutting alternative for businesses. By installing solar panels, companies can lower electricity bills and reduce their environmental footprint. With the new Solar ATAP programme, alongside double tax incentives for adopting green technology, businesses can maximize their solar benefits while contributing to a greener future.

Choose The Right Solar Solution For You

Solar ATAP

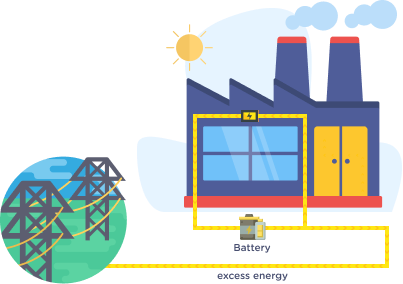

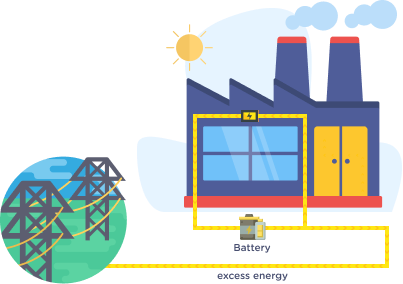

Take your commercial solar system to the next level with Solar ATAP. This programme allows businesses to install larger rooftop or facility-mounted systems, export surplus energy to the grid for market-based credits, store excess power in an optional battery, and enjoy greater energy independence, stability, and long-term saving.

SELCO

Generate and use clean energy straight from the sun. SELCO is a cost-effective way to power your home, cut electricity bills, and reduce reliance on the grid, all while protecting yourself from rising tariffs and embracing a more sustainable lifestyle.

Solar ATAP

SELCO

Upgrade Your Solar System with Battery

Enjoy Double Tax Incentives When You Go Solar

Don't miss out the benefits the government is offering!

Why Go Solar?

Reduced Electricity Costs

Enhanced Brand Image

Increased Property Value

Government Incentives

Reliable Energy Source

We Have The Solar Financing Options

You Need

Your Business, Your Energy

Commercial Solar Savings Calculator

Know Your Savings and Affordability

Residential

Commercial

Current electricity bill

New electricity bill

Monthly savings

Savings

per mth

Estimated cost

Easy Payment

Installment (0% p.a)

Net InvestmentFor Installment Term

Per Month

Per Month

Protecting Our Planet Starts With You

|

kWp Solar PV installed |

|

Carbon Dioxide

Metric tonnes avoidance per year |

|

Tree Seedlings

Trees grown for 10 years |

|

Passenger Cars

Cars taken off road for 1 year |

Financing Plans

Choose the best plan to suit your needs

ZERO CAPEX

Partner with a solar provider & pay a fixed monthly fee for the generated electricity.

Outright Purchase

Own the system & enjoy long-term energy cost savings.

Business Loan

Opt for an affordable and hassle-free business loan.

Credit Card

Up to 60-month 0% Interest Credit Card Instalment Payment Plan.

Other Commercial Financing Options

Alternative financing options available for commercial solar projects.

Supply Agreement of Renewable Energy (SARE)

SARE makes green energy accessible to businesses by allowing investors to fund a own-on-site renewable energy generation on the consumer premises.

Find Out MoreLet us help you to find out your potential savings!