Complete Guide to Residential Solar Financing Options in Malaysia

Last updated: 11 Nov 2025

Discover the 4 main residential solar financing options in Malaysia: Outright Purchase, 0% Credit Card Instalment Plan, Personal Loan, and Rent-to-Own.

More Malaysian homeowners are switching to solar every year, driven by rising electricity bills, attractive government incentives, and the desire to live more sustainably. But for many, the biggest question is “How do I pay for it?”

This guide walks you through the 4 most popular financing methods: Outright Purchase, Credit Card 0% Instalment Plans, Personal Loans, and Rent-to-Own (RTO), so you can decide which fits your lifestyle and budget best.

Why Financing Matters for Malaysian Homeowners

1. Electricity Tariffs Are Rising

High-usage households consuming over 600 kWh a month are already facing higher TNB tariffs. With solar, you can slash your bills by up to 90% – but the right financing plan makes that saving accessible from day one.

2. Upfront Costs Are a Barrier

A typical 6–10 kW solar PV system in Malaysia costs between RM25,000 and RM45,000. That’s where financing steps in – spreading the cost over time so you can enjoy solar savings immediately.

The 4 Main Financing Options in Malaysia

1. Outright Purchase

Make a one-time payment, and the system is yours from day one.

- Immediate ownership

- Lowest lifetime cost (no interest or financing fees)

- Highest return on investment

- Warranty + free first-year maintenance

- Requires significant upfront capital.

2. Credit Card 0% Instalment Plan (IPP)

With participating banks like CIMB, Maybank, HSBC, and more, split the total cost into 12-60 monthly instalments at 0% interest.

- RM0 upfront if approved

- Immediate ownership

- Spread payments with no interest

- Free first-year maintenance

- Requires credit card eligibility and a sufficient limit

- Limited to banks offering IPP promotions

3. Personal Loan

Apply for a personal loan with repayment terms of up to 10 years.

- No large upfront payment

- Longer repayment terms (up to 10 years)

- Immediate ownership

- Warranty + first-year maintenance

- Interest rates apply (typically 3–6% depending on bank and tenure)

- Requires credit checks and an approval process

4. Rent-to-Own (RTO)

Pay a fixed monthly fee over 5–10 years, and ownership transfers to you at the end of the contract.

- RM0 upfront

- Monthly fees usually lower than your TNB bill

- Maintenance and warranty bundled in

- No bank or credit card needed

- Locked into a long-term contract

- Higher total cost compared to outright purchase

- Limited flexibility to exit early

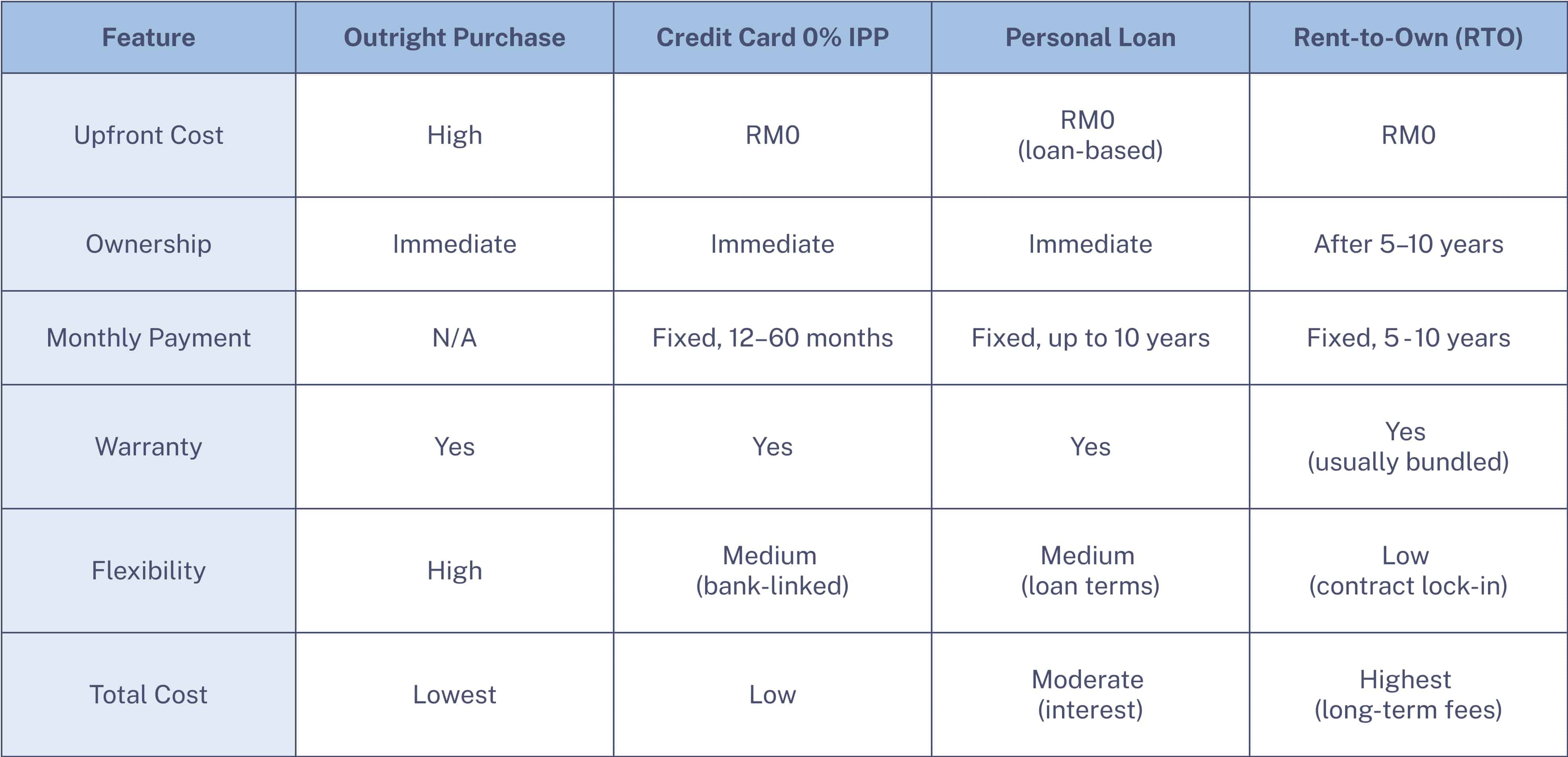

At-A-Glance Comparison

How to Decide Which Option Fits You

Go for Outright Purchase if →

You want the best ROI, lowest cost, and have the capital or credit card limit.

Go for IPP if →

You want ownership + flexibility but prefer spreading costs without interest.

Go for Personal Loan if →

You need longer repayment terms (up to 10 years) and can manage bank financing.

Go for Rent-To-Own if →

You want a no-hassle, no-bank path to solar with RM0 upfront.

Real-Life Example: The Cost Difference

Outright Purchase:

RM30,000 upfront, ROI in ~4-5 years.

0% IPP (60 months):

RM500/month, ROI in 5 years.

Personal Loan (10 years, 4% interest):

≈RM350/month (approx.), ROI slightly extended due to interest.

Rent-To-Own (10 years):

≈RM250/month (approx.), ownership after 10 years, higher overall cost.

Conclusions

The sun is free – and solar should be accessible. With buySolar, you can explore all these financing options under one roof – compare plans, request multiple quotes, and make the smart choice for your home.

Get in touch with buySolar today to find out more.