Rent-to-Own vs. 0% Instalment Plan: Which Solar Financing Option Is Right for You?

Last updated: 8 Sept 2025

Compare 2 popular ways to finance your home solar panels in Malaysia and decide which option gives you better value, flexibility, and long-term savings.

Thinking about going solar, but worried about the upfront cost or loan obstacles? In Malaysia, two consumer‑friendly finance options stand out:

- Rent‑to‑Own (RTO)

- 0 % Instalment Payment Plan (IPP) offered via credit cards

Let’s compare them so you can decide which suits your home and financial needs best.

What Are These Financing Options?

1. Rent‑to‑Own (RTO)

Rent-to-Own offers you a zero‑down, fixed monthly payment plan. No credit checks, no bank loan needed. You enjoy solar from Day 1, and the system usually becomes yours after 5-10 years, complete with maintenance and warranty included. Payments are often lower than your typical TNB bill from the start.

2. 0 % Instalment Payment Plan (IPP)

Available through a wide range of credit cards. You pay for your solar installation with your card and convert the total into fixed, interest‑free instalments of 12-60 months. You own your system immediately, with no hidden fees. Maintenance may or may not be included, depending on merchant arrangements.

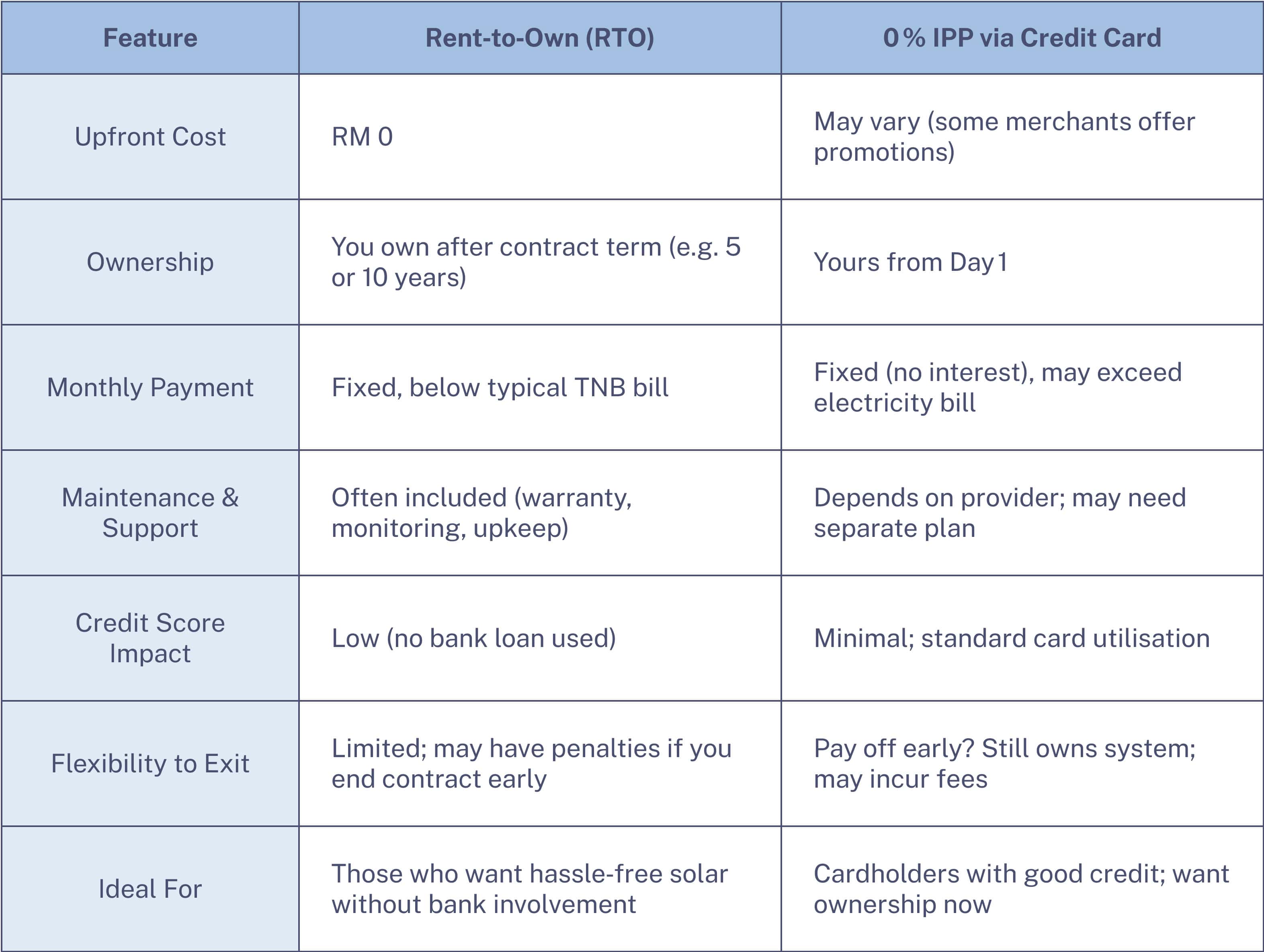

Let’s Compare:

Why These Options Matter for Malaysian Homeowners

Rent‑to‑Own is perfect for homeowners who want solar with no upfront cost, minimal hassle, and consistent maintenance in the package. Many homeowners find that the monthly rent is lower than their existing electricity bills – meaning savings start right away.

On the other hand, 0 % IPP gives you outright system ownership from Day 1 – ideal if you’re financially able to put it on your credit card and want to avoid long-term contracts. If your electricity bill is high and your card issuer offers 0% instalments with promos or cashback, this could be the cheapest route in the long run.

For Example:

Suppose you’re considering a 6 kW system priced at RM 30,000:

With RTO, your monthly payment may be around RM 300, which could be less than your TNB bill, and includes service and ownership transfer later.

With 0 % IPP, you pay RM 30,000 over 36 months (RM 833/month). No maintenance is included unless arranged separately.

Key Factors to Consider in Your Decision

- Monthly budget vs. bill savings – will your payment be lower than your existing TNB bill?

- Ownership timeline – do you want the system now, or later?

- Included support & maintenance – want peace of mind built in?

- Contract flexibility – can you commit 5–10 years?

- Credit usage and score impact – prefer avoiding bank loans?

Final Thoughts:

Both finance options have strong appeal for Malaysian homeowners:

- Go for Rent‑to‑Own if you want solar without any upfront cash, inclusive maintenance, and easy entry – even if ownership comes later.

- Choose 0 % IPP if you’re ready to own the system immediately, have access to promo terms, and want full control without being tied to a provider contract.

Want to know more about other financing options? Contact us today! We promise to help you kickstart your solar journey with confidence and clarity.